powerball lottery payout calculator|powerball cash value calculator : iloilo Estimate how much money you will receive and compare the Powerball lump sum vs. annuity payouts with this tool. See the gross, federal, and state taxes .

Learn typed code through a programming game. Learn Python, JavaScript, and HTML as you solve puzzles and learn to make your own coding games and websites.

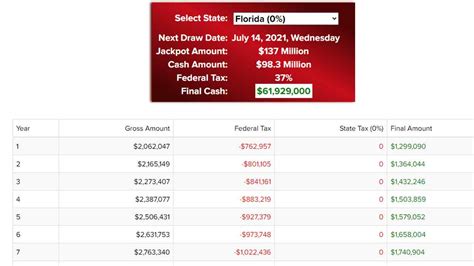

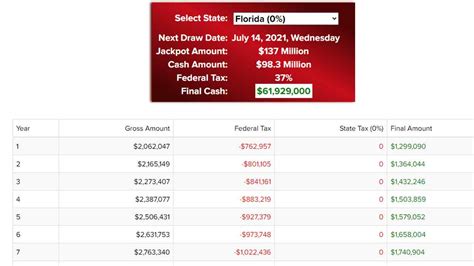

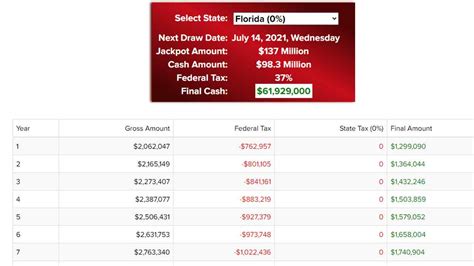

powerball lottery payout calculator,Use this tool to compute how much tax you have to pay and compare the net payout of the lump sum or annuity option after winning the Powerball jackpot. Enter the jackpot amount, select your state and see the payout chart for 30 annual payments. Tingnan ang higit paAs you might already know, when a player wins the Powerball jackpot, they have to choose between a single lump sum or 30 annual . Tingnan ang higit pa

If you’re lucky enough to win the lottery, there’s one important decision to make: how to collect your prize. There are two main ways to do so: 1. Getting a lump sum payout, 2. Collect your prize in annuity payments over the next 30 years. Tingnan ang higit pa

The Powerball payout chart below captures the different prize tiers and odds of winning. Figures in this chart are rounded to the nearest one and are based on a single $2 play. Tingnan ang higit paAs we said before, the IRS treats lottery winnings as taxable income, which means that you’ll be paying both federal and state tax. Tingnan ang higit pa

Estimate how much money you will receive and compare the Powerball lump sum vs. annuity payouts with this tool. See the gross, federal, and state taxes .powerball lottery payout calculator Powerball Jackpot Tax Calculator. Here’s how much taxes you will owe if you win the current Powerball jackpot. You can find out tax payments for both annuity and .Calculate your lottery winnings after tax using current tax laws in any state. Compare lump sum and annuity payout options for Megamillions, Powerball, Lotto, etc.

Calculate how much tax you have to pay and compare the lump sum and annuity options for Powerball jackpot. Enter the jackpot amount, select your state and see the payout chart and net income for each option. Discover Your Total Payout and Taxes with Our US Powerball Lottery Calculator - Learn More About the Payment Options Available to Proud Winners. Compare the net payouts of Powerball jackpot annuity and cash options after federal and state taxes. See the annual and total payouts for each state and filing status.

Calculate Powerball taxes in your state to see how much the lottery is worth after taxes with a lump sum payment or the annuity option. Powerball Jackpot Analysis and Tax Calculations. Check out a payout analysis of the current Powerball jackpot below. You'll find out the advertised annuity and lump .Explore winning strategies with SW Stock's free Powerball Calculator. Compare lump-sum vs annuity payouts for accurate financial decision-making on your lottery gains.

In Idaho and Montana, Powerball is bundled with Power Play® for a minimum purchase price of $3 per play. Select five numbers between 1 and 69 for the white balls, then select one number between 1 and 26 for the red Powerball. Choose your numbers on a play slip or let the lottery terminal randomly pick your numbers. Annuity Payment Schedule. Here's how the current Powerball jackpot will be paid if the annuity option is selected. Current Powerball jackpot. Wednesday, Jun 26, 2024. $95,000,000. Withholding (24%) Federal tax. Select your filing status. -$22,800,000.The Non-Cash payouts are no longer equal payments, and are now annuitized, starting lower and increasing each year by about 4-5% depending on the lottery you are playing. See INSTRUCTIONS below. Changed Lump Sum payouts on 8/25/2021 base on Est Cash Value based on each of the original sites. REMEMBER: enter '1200' for 1.2 billion.powerball cash value calculator Powerball Payout Chart; Prize Level Payout Odds Fewest Ever Winners Highest Ever Winners Average Winners Per Draw Winners in Last Draw; Match 5 + PB: Jackpot: 1 in 292,201,338: 0: 4: 0.1: 0: Match 5: $1,000,000: . Powerball.net is not affiliated with the Multi-State Lottery Association or any State lottery. The content and .powerball lottery payout calculator powerball cash value calculatorLegal Stuff: All calculated figures are based on a sole prize winner and factor in an initial 24% federal tax withholding. A portion of this information has been provided by usamega.com, and all figures are subject to fluctuation resulting from (but not limited to) changes in tax requirements, lottery rules, payout structures, personal expenditures, etc.

The Non-Cash payouts are no longer equal payments, and are now annuitized, starting lower and increasing each year by about 4-5% depending on the lottery you are playing. See INSTRUCTIONS below. Changed Lump Sum payouts on 8/25/2021 base on Est Cash Value based on each of the original sites. REMEMBER: enter '1200' for 1.2 billion. In this case, that excess amount is $49,624. To break it down, you would owe $16,290 in taxes on the first $95,376 of your income and 24% of the remaining $49,624. Consequently, out of your $100,000 lottery winnings, your total federal tax liability would be $28,199.76. Use the lottery tax calculator to estimate the tax amount deducted from a lottery prize, received as either a lump sum or through annuity payments. . you may check our Powerball and Mega Millions payout calculators. . the calculator shows a lump sum payout of $52,000,000. If you're a single filer living in Arizona, it calculates Federal .

powerball lottery payout calculator|powerball cash value calculator

PH0 · powerball winning numbers payout breakdown

PH1 · powerball winning numbers calculator

PH2 · powerball mega millions calculator

PH3 · powerball cash value calculator

PH4 · powerball annuity payout table

PH5 · powerball annuity payment calculator

PH6 · lottery taxes by state calculator

PH7 · Iba pa

PH8 · 30 year lottery annuity payout calculator